Additional to IMI

The AIMI (Additional to the Municipal Property Tax) is a new additional tax to the IMI (Municipal Property Tax), the payment of which is annual, and which is charged to all individual and collective taxpayers, who are holders of real estate assets whose value total exceeds €600,000.

In this guide, we'll explore everything you need to know about this tax.

AIMI, what is it? (Topâ–²)

AIMI , an acronym for Additional Municipal Property Tax, came into force on January 1, 2017. This new annual tax replaces, under new guidelines, the previous Stamp Tax, which applied a rate of 1% on properties with a Tax Asset Value (VPT) exceeding one million euros.

Compared to the extinct stamp tax on luxury properties, the main change lies in the fact that now it is not individual properties that are taxed, but rather the taxpayer's global assets. Furthermore, the increase in tax is focused on assets of medium value. In some cases, owners of higher-value properties may even benefit from tax relief.

Unlike the IMI, the AIMI is not a municipal tax, as it goes directly into the State's coffers . The revenue from the Additional IMI is allocated to the Social Security Financial Stabilization Fund (FEFSS).

AIMI, who pays, when and how much they pay? (Topâ–²)

The new tax is applicable to all taxpayers, whether natural or collective, who, on January 1st of each year, are identified in the property matrix as owners of real estate in Portugal. This heritage may include urban buildings intended for housing or land for construction, as long as their global value exceeds €600,000 . To determine this value, the sum of the VPT (Tax Patrimonial Value) of all properties subject to taxation must be considered. The VPT is the tax value established by the Tax Authority (AT) for each property, calculated based on its gross construction area. AT automatically updates this value every three years.

Normally, this update results in an increase in IMI and AIMI, leading to, year after year, requests for property revaluation from the AT with the aim of reducing the amount of taxes payable. It is important to note that any revaluation of the VPT will only be considered in the subsequent fiscal year.

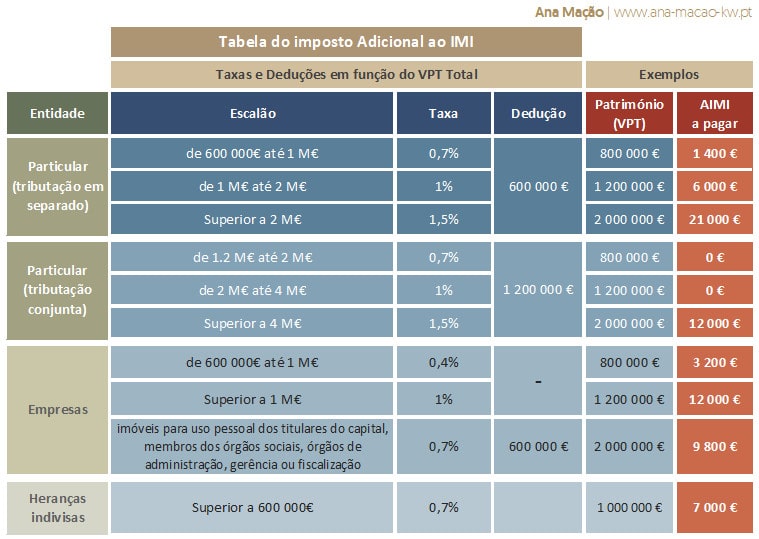

AIMI fees vary depending on the type of owner and the amounts involved. See the table below with the different rates and some examples for demonstration purposes:

- For individual taxpayers the rate will be 0.7% on the amount exceeding €600,000 . If this amount exceeds €1,000,000, the applicable rate will be 1% on the amount exceeding this limit.

- AIMI is also applicable to undivided inheritances , following rules similar to those for individual taxpayers. This tax may be levied on the inheritance in its entirety or only on each heir's share. For this to occur, the heirs must express this intention to the AT, in a process that must be initiated by the head of the couple and confirmed annually by all the heirs.

- In the case of a collective taxpayer, the single rate applied will be 0.4% of the total asset value. If the properties are intended for the personal use of capital holders, members of corporate bodies or any administration, management or supervisory bodies, the rate to be applied will be 0.7%.If the VPT exceeds €1,000,000, a marginal rate of 1% will be applied. For companies, there is no place for deductions, except if the properties are directly related to their activity, in which case they can exceptionally deduct €600,000.

Taxpayers who are married or in a civil partnership can opt for joint taxation, which can be quite advantageous as it allows for a higher deduction and, consequently, a reduction in the amount of this tax payable. In other words, in this modality the deduction would rise from €600,000 to €1.2 million and, in certain situations, it may even be exempt from paying AIMI. It all depends on the properties the couple owns together.

How to opt for joint taxation?

The choice for joint taxation in AIMI is made by submitting a declaration on the Finance Portal, between April 1st and May 31st. This regime remains active until the couple decides to change it, submitting a new declaration.

If you are unable to carry out this operation in time and within the established deadline, which is September 30th, you can still do it later, during the following 120 days. However, you will have to pay the tax calculated by AT without this option. After the request for joint taxation, AT will settle the accounts.

What are the deadlines for paying AIMI?

The settlement of AIMI, that is, the presentation of the tax calculation, takes place between the 1st and 30th of June. As for payment, it must be made in a single installment, between September 1st and 30th.

The consultancy Deloitte provided a set of simulations that facilitate understanding the impact of this tax, depending on the owner's profile.

When is the Additional IMI paid?

If you are covered by the payment of Additional Municipal Property Tax (AIMI), mark your calendar now: the payment period starts on September 1st and you have until the last day of that month to pay it.

Unlike what happens with IMI, where it is possible to make the payment in stages if it exceeds 100 euros, with AIMI such an option does not exist. Taxpayers receive a single billing note, based on the Tax Asset Value (VPT) of their properties, registered on January 1st of the year in question, and must make full payment at once.

AIMI, exemptions and deductions (Topâ–²)

Owners of urban properties that fall into the commercial, industrial or service and other categories are exempt from paying AIMI.

Owners of urban properties that fall into the commercial, industrial or service and other categories are exempt from paying AIMI.

As for the possibility of deducting AIMI from the IRS, this is now restricted to the portion of the collection corresponding to income from properties subject to this additional tax, whether in the context of rental or accommodation.

Collective entities have the option of deducting the amount paid as AIMI in IRC . This deduction can be applied to both taxable income and collection, as long as the properties in question are intended for rental. For a better understanding, you can consult simulations for different scenarios here.

In situations of undivided inheritance, the head of the couple has the option of submitting a declaration identifying the heirs and their respective shares. Each heir's share will then be added to the tax asset value of the properties of which he or she individually owns.

How can I challenge an AIMI charging decision? (Topâ–²)

If you do not agree with a charging decision regarding the IMI Additional, you have the possibility of submitting an appeal. It is recommended that you consult a lawyer or specialized tax advisor to ensure that your rights are defended and for detailed guidance on the appeal procedure. Here are the steps to follow:

- Analyze the billing notice: Read the billing notice carefully to understand the grounds and reasons that make you eligible for payment of Additional IMI.

- Prepare your defense: Compile all pertinent documents and information that can corroborate your position and demonstrate that the valuation of the property(s) in question is correct.

- Pay attention to deadlines: The period to submit an appeal is short.In the case of Additional IMI, you have 30 days from the date of receipt of the collection notification. This is a strict deadline and, if exceeded, may result in the loss of the right to appeal.

- Submit your appeal: Formalize your appeal in writing with the finance service responsible for the collection, explaining the reasons for your disagreement.

- Wait for the decision: After submitting the appeal, the Tax Authority has four months to complete the process. If you do not receive any response within this period, it will be assumed that your request has been rejected.

- In case of an unfavorable decision: If the decision is upheld, you can still continue with your defense. If you do not agree with the tax administration's verdict, you have the option of proceeding with a hierarchical appeal, contentious appeal or judicial challenge.Â

Frequently Asked Questions aboutAIMI (Topâ–²)

These are some of the most frequently asked questions about the additional IMI:

1. What is the Additional IMI?

This is a tax applied to all owners of urban properties intended for housing or land for construction, whose global asset value exceeds €600,000.

Who is subject to paying Additional IMI?

This tax is levied on all taxpayers, whether natural or collective, whose sum of Tax Asset Values (VPT) on January 1st of the tax year in question exceeds the limits established by law.

2. How is the Additional IMI calculated and what is the applicable rate?

- a) For individual taxpayers and undivided inheritances, the rate is 0.7% on the value exceeding €600,000. If the value of the assets exceeds €1,000,000, the rate increases to 1%. In the case of couples with joint taxation, these limits double.

- b) For collective taxpayers, the single rate is 0.4% of the total asset value. However, if the assets are intended for the personal use of the administrative bodies, the rate will be 0.7% (or 1% if the VPT is greater than €1,000,000).

3. Does the Additional IMI only apply to residential properties?

The tax is levied on properties intended for housing, land licensed for construction and undivided inheritances.

4. Does the Additional IMI only apply to properties located in Portugal?

Yes, regardless of the owner's nationality.

5. Is the IMI Additional charged annually?

Yes, the Additional IMI is payable annually.

6. Is the Additional IMI cumulative with other taxes on the property?

Yes, this tax can be combined with other property taxes, such as the IMT (Municipal Tax on Onerous Property Transfers) or the IS (Stamp Tax, which is levied on donations). These are charged independently and can be accumulated with IMI and Additional IMI. It is wise to consult an attorney or tax advisor for a complete understanding of the taxes applicable to your property.

7. What is the objective of the Additional IMI?

This measure, which resulted from the parliamentary initiative of the Left Bloc, aims not only to increase the State's tax revenue, but also to discourage the accumulation of high-value properties.Through this tax, the State intends to combat the concentration of wealth and promote fiscal equity.

8. Which properties are exempt from AIMI?

The AIMI applies to urban buildings, including construction land, with the exception of buildings classified as 'commercial, industrial or services' and 'others'. Properties that, in the previous year, were exempt or were not subject to payment of IMI are also excluded from this tax.

In short, the Additional IMI is a supplementary rate to the regular IMI, applied exclusively to high-value properties. This measure aims to increase tax revenue and mitigate the concentration of wealth. If you own a property valued at more than €600,000, it is crucial to be informed about the obligation to pay this additional amount.

It is important to note that the rates and regulations relating to this tax may change annually. Therefore, it is essential to stay up to date with changes in legislation and regularly check your tax situation to ensure that you comply with all tax obligations.

Related articles