The Portuguese real estate market has been a focus of attraction for foreign investors since 2015, with special emphasis on this summer of 2023. Whether in the housing or commercial segments, year after year, the numbers never cease to surprise us. This constant and growing interest is evident both in investments aimed at housing and those destined for the commercial sector, reinforcing the versatility and dynamism of the Portuguese real estate market.

Impressive Performance in Numbers

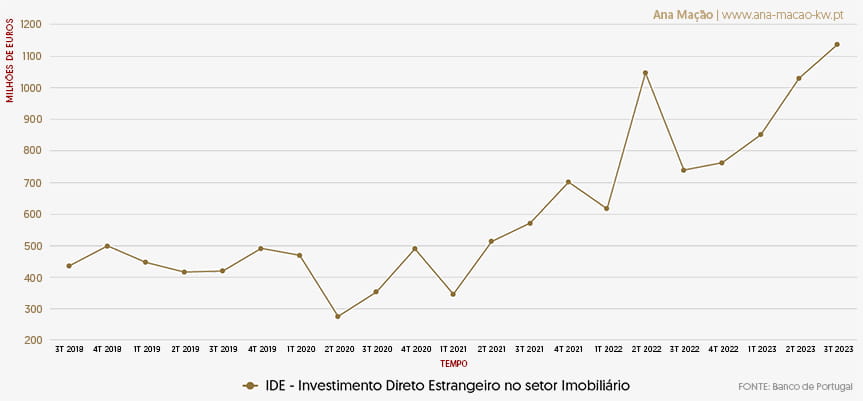

In the Third Quarter of 2023, the volume of investment in the real estate sector reached 30,447 million euros , exceeding the value of the same period in the previous year by 14% and almost 4% more than in the previous quarter of 2023. Furthermore, the accumulated result for the first nine months of 2023 reached the impressive figure of 3,018 million euros, surpassing the values of previous years.

This significant increase in FDI in the real estate sector is particularly notable considering the current international environment, where financial conditions are much more restrictive. Inflation, rising interest rates, wars in Ukraine and Palestine are negative factors that have contributed to penalizing the real estate sector in the rest of Europe. Furthermore, despite the slowdown in the Eurozone real estate market, Portugal managed to maintain a healthy growth rate, resisting general trends and demonstrating enviable robustness.

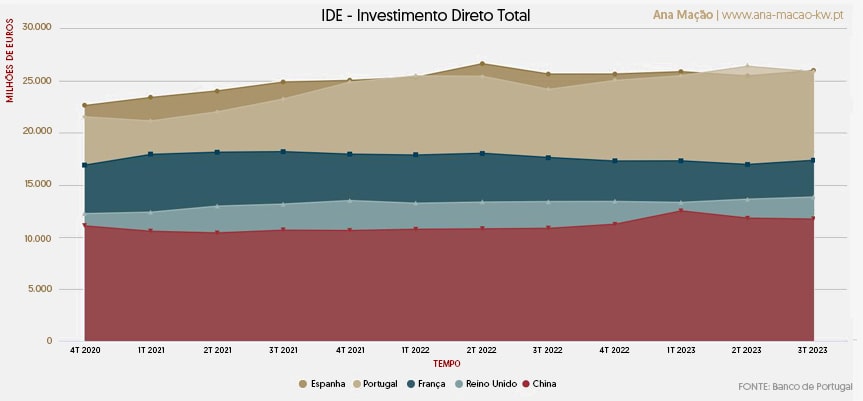

The weight of foreign direct investment in the Portuguese economy was higher than the average for OECD countries, in the period 2008-2022

This growth is all the more impressive because it appears in countercycle with the remaining foreign direct investment (FDI) in other sectors of the economy, where there was a slowdown during the 3rd Quarter of 2023.

Total Foreign Direct Investment fell 12% compared to the same period in 2022

Nationalities that currently invest most in Portuguese real estate

The nationalities that usually invest the most in the real estate sector in Portugal include Brazilians, North Americans, French and Chinese .

But this Top of Nationalities is not static. The fluctuations are annual and in 2023 it is buyers of North American origin who stand out the most. According to SEF, North Americans were the ones who invested the most in real estate in Portugal in the first quarter of the year, with a total value of 25.1 million euros , tripling the value compared to the same period last year!

Which regions of Portugal most attract foreign real estate investment?

The regions of Portugal that most attract foreign real estate investment are:

- Lisbon: This city is one of the most dynamic in terms of real estate investment across Europe, occupying 6th place in the ranking of European cities with the greatest growth potential, according to the EMEA Investor Intentions Survey 2023 report.

- Porto: Porto offers properties with prices around 30% lower compared to Lisbon, making it one of the regions that has attracted the most foreign investors interested in the real estate sector in recent years, with 2023 not far off.

- Algarve: This region is recognized for its tourist appeal, especially for its famous beaches.The Algarve attracts a large number of tourists and investors, especially during the summer months, but in 2023, new real estate projects have been reinforcing this trend.

- Madeira Island: Offering incentives and support for investment, Madeira is an attractive choice for investors, with advantages such as a favorable tax regime, low bureaucracy and reduced operating costs. These characteristics make the island an interesting destination for real estate investment.

A Macroeconomic Perspective

Until June 2023, the 'stock' of Foreign Direct Investment (FDI) in Portugal was 174,000 million euros , which represents 69% of the Gross Domestic Product (GDP) , while Portugal's direct investment abroad reached 66,000 million euros. euros, corresponding to 26% of GDP.

These numbers highlight the relevance of foreign investment in the Portuguese economy, particularly in the real estate sector, as well as the growing internationalization of its economy. However, there are still some dark clouds on the economic horizon:

- Inflation and rising Interest Rates: Inflation and rising interest rates have negatively impacted the real estate sector. Inflation increased construction costs and rising interest rates made mortgage credit more expensive, reducing demand for properties. However, there are expectations that inflation could soon reach the ECB's 2% target, which could lead to a reduction in interest rates, probably from spring 2024.

- War in Ukraine: Russia's invasion of Ukraine in 2014 brought substantial economic and geopolitical impacts to Europe, including affecting the real estate market. These effects include increased inflation, economic uncertainty, fluctuations in energy prices and supplies - particularly for nations dependent on Russian natural gas - and possible refugee flows, influencing local markets. However, the most significant impact can be seen in investor confidence.

- Situation in Palestine: The situation in Palestine, being a long-standing conflict, has a less direct impact on the European real estate sector, especially when compared to the effects of inflation, interest rates or the war in Ukraine. The Israeli-Palestinian conflict influences the European real estate sector in a less direct and more complex way, and it is still premature to quantify its impact. However, it is recognized that events of this nature tend to disrupt market stability.

But, are Golden Visas really over?

Portugal granted 11,628 Gold Visas over 10 years , representing a total investment of approximately 6.7 billion euros , with the largest share going to the purchase of properties, according to the Foreigners and Borders Service (SEF).

But, despite these impressive numbers, the Golden Visa program ended in July 2023, with the approval of Decree Law No. 56/2023 , better known as the More Housing Program. After this date, no new applications for granting Residence Permits for Investment Activities (ARI) will be accepted, although the renewal of permits already granted will remain valid.

Despite this change, this regime has not completely ended, applications for residence permits associated with investments continue to be admissible, as long as they apply to the following types:

- Transfer of capital in an amount equal to or greater than €500,000 , intended for the acquisition of parts of non-real estate collective investment entities , which are constituted under Portuguese legislation, whose maturity, at the time of investment, is at least 5 years and at least 60% of the value of the investments is made in commercial companies based in national territory;

- Transfer of capital in an amount equal to or greater than €500,000 , intended for the establishment of a commercial company with headquarters in national territory, combined with the creation of 5 permanent jobs , or to reinforce the share capital of a commercial company with headquarters in national territory, already constituted, with the creation of at least five permanent jobs or maintenance of at least ten jobs, with a minimum of five permanent, and for a minimum period of three years.

Now,the revocation of residence permits for real estate investment activities puts an end to the modalities of acquiring real estate or participating in real estate investment funds, for the purposes of obtaining Gold Visas, but leaves the door open for other entities, such as Investment Funds. Venture Capital or others, according to the interpretation of lawyer João Ricardo Nóbrega from RSA :

the complexity inherent to the recent changes to the Golden Visa program, with the introduction of the investment modality in Non-Real Estate UCIs, mainly venture capital funds , requires... a detailed analysis covering aspects such as investment policy, asset composition, intrinsic knowledge of the activities of the companies in which the Fund participates, the maturity time of investments, etc.

It is essential that in their analysis and interpretation (the technicians at AIMA: Agency for Migration and Asylum Integration), recognize that the mere presence of real estate on a company's balance sheet does not characterize it, in itself, as a real estate entity . This distinction is vital to avoid erroneous categorization that could unfairly exclude eligible candidates.... It will be the result of this binomial that will dictate whether or not this will be the Golden Era for “non-real estate” collective investments!

A Look at the Future

The real estate market in Portugal showed an increase of around 67% in the volume of real estate investment in 2022 compared to the previous year, reaching 3.3 billion euros. This remarkable growth signals a promising future for the sector, which continues to attract investors from around the world despite global economic challenges.

However, the big unknown remains: will the end of Golden Visas and the announced extinction of the Non-Habitual Resident Status (RNH) in the State Budget for 2023 be offset by the attractiveness of the real estate market in the eyes of international investors?

The record foreign investment in Portuguese real estate in 2023 is not only an indicator of the strength of the market, but also proof of investors' confidence in the country's economy. This phenomenon, occurring in a context of global financial uncertainty, highlights the resilience and dynamism of the real estate sector in Portugal, promising further development and growth in the future.