According to the Residential Price Index released by Confidencial Imobiliário, Portugal (mainland) ended the year 2020 with a 1.8% increase in sales prices in the residential market, compared to the pre-Covid-19 period.

The last month of 2020, December, helped to attenuate the stabilization of sales prices recorded throughout the year. It is recalled that the successive confinements and restrictions caused by the Covid-19 pandemic imposed a brake on the increasing price evolution in the residential market.

This braking was not uniform and varies with the typology of the property or the region of the country. The demand for housing and land continued to rise, a consequence of the confinement, but as for the demand and sale of apartments, this fell more sharply, inducing a generalized effect of lower prices in the market, with emphasis on the resale market.

When we look at the chart above, we can see that, starting in March, house selling prices stabilized , but from September onwards confidence returned to the market and prices started to rise again.

However, when we compare the current growth rates with those observed in January 2020 (17.4%) it is clear that the trend is towards greater instability and cautious price growth.

Foreign buyers

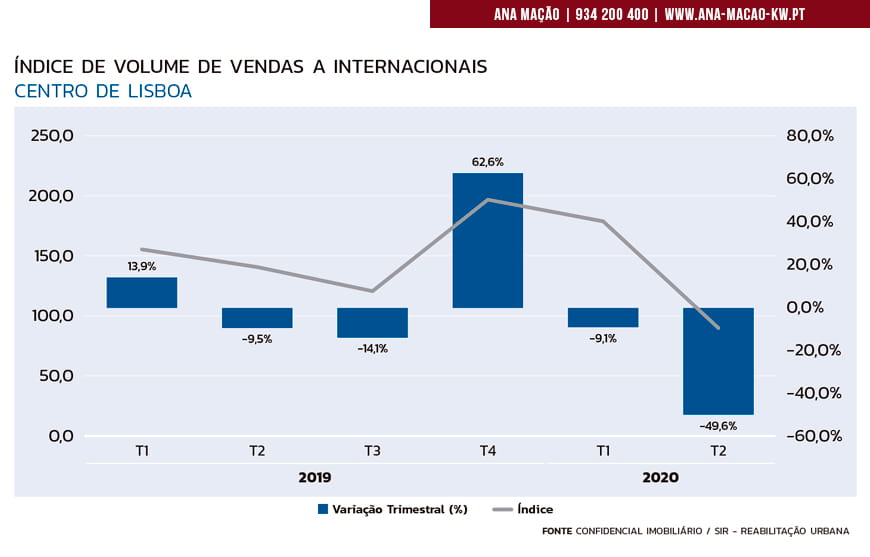

On the other hand, the restriction measures not only hampered mobility at the country level, but also the influx of tourists and, by extension, foreign investors. The drop in the number of air routes was tremendous. According to NAV, the person responsible for air navigation in the Portuguese space, in 2020 the pandemic caused a drop of more than 20 years in the number of flights , having observed a drop of 58% compared to 2019 (the worst record since 1998).

It is clear that the real estate market has clashed head-on with this reality and, although there are clear signs that Portugal has not lost interest by international investors, the impact in terms of the number of transactions is notorious. In Lisbon and Porto, the historic areas and ARUs suffered the most. As an example, in Lisbon, in the second quarter of 2020 , sales volume from international buyers fell 49% :

However, from the 3rd quarter onwards, I and many real estate agents felt a reignite of the flame with respect to this segment of buyers. Through foreigners who currently reside in Portugal, in rented houses and who intend to acquire their own housing, or through a new wave of international customers who continue to invest in Visa Gold , transactions in this segment have increased again.

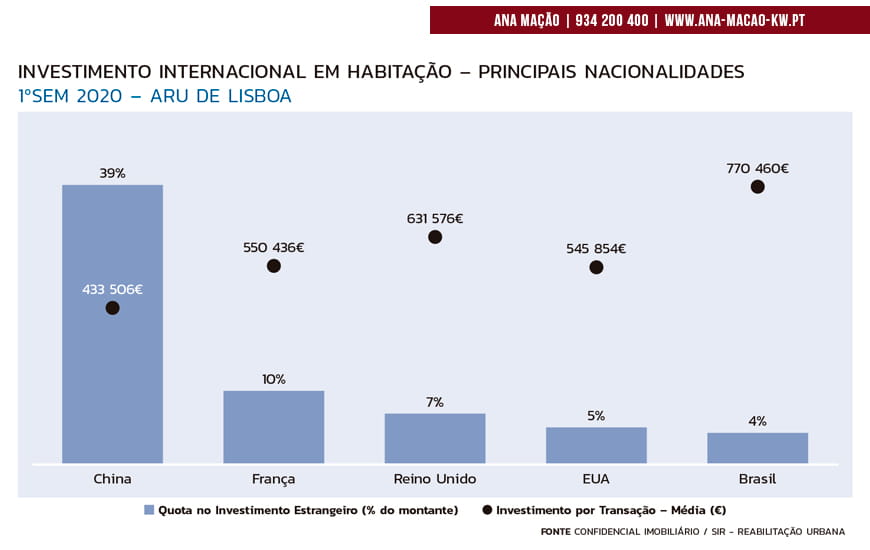

The nationality of foreign buyers has varied over time, but after the arrival of the pandemic, we have seen a resumption of the Chinese, and an increase in the share of residents of the United Kingdom and France, which is about to continue.

Discrepancies at regional level

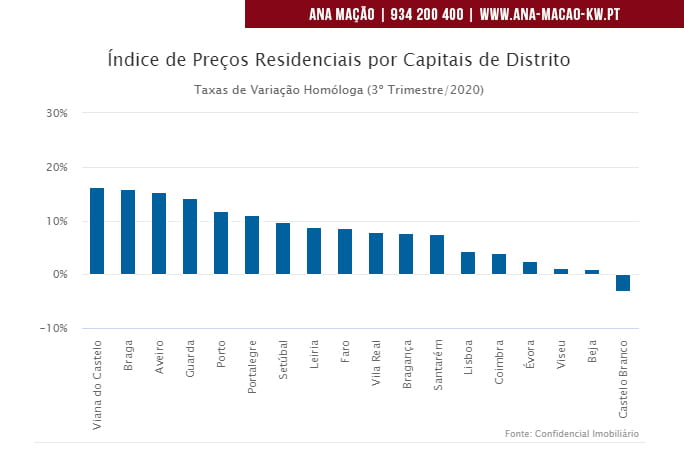

Fluctuations in sales prices per square meter of real estate were not felt homogeneously throughout the territory. If we observe the year-on-year variations below compared to the previous year, we can see that this impact was greater outside Lisbon and Porto.

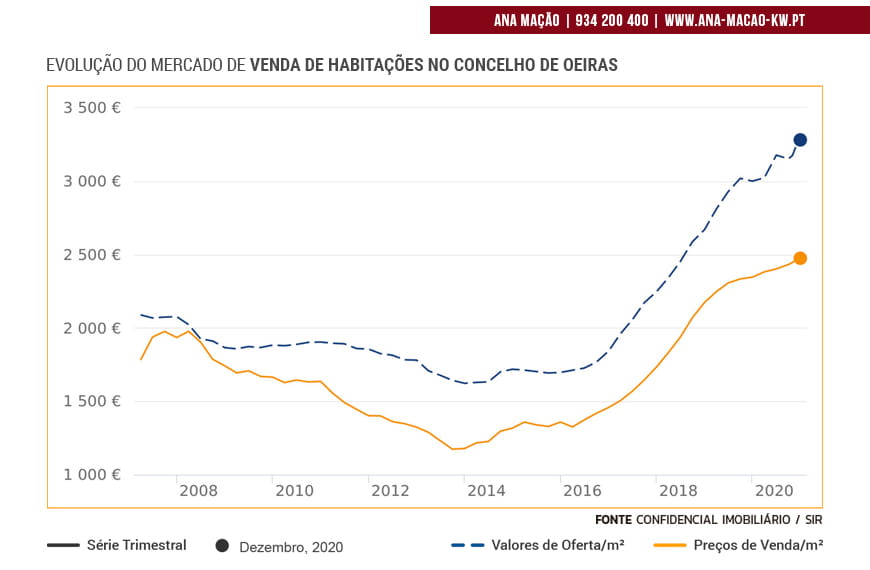

On the other hand, among the different municipalities in the metropolitan areas of Lisbon and Porto, the impact was felt differently. For example, in the municipality of Oeiras, selling and asking price prices resisted and barely suffered from the pandemic, except in some properties with older or worse location, which were corrected in the order of 5 to 7%.

Forecasts for 2021 in the housing sales market

In this context and in view of the new measures of restriction of the State of Emergency, it is remarkable that the dynamics observed in 2020 will be repeated in most of the first semester, with greater incidence in the first quarter , and it is expected that downward price corrections are likely to last. , in the residential property resale market.

Regarding the sale of land, I do not expect any downward corrections, since the increase in the activity of building new houses is a reality that promises to remain high .

The segment of construction of new properties has not lost strength over the past year, despite some delay due to breaks in the supply chain for construction materials and the quarantine of some workers infected with Covid-19, and is contributing to maintain some upward pressure on sales prices .

In short, for those who expected the pandemic to bring sharp drops in sales prices in the real estate sector, today it is clear that demand and supply continue to drive the market trend! In large metropolitan areas, demand is greater than supply, either because of the influx of populations that continue to abandon the interior, or because of the demand of international buyers who want housing in Portugal. Brexit is still unknown, but I believe that the signs are encouraging and that the client from the United Kingdom will contribute to reinforce this trend.

In the opposite direction, the rental market is in a general decline in prices , especially in the medium / low segment, due to the increase in the supply of houses for rent. The divestment in the tourism housing market (LA), motivated by the crisis that affects this sector, has temporarily returned a lot of properties to the long-term rental market. I do not expect the year 2021 to change this trend.

Source: The Residential Price Index, is based on statistics from the SIR-Residential Information System, under the responsibility of the Confidencial Imobiliário portal