Autonomous Fraction

The autonomous fraction is a common term in the real estate market, especially in the context of condominium properties, with a higher incidence in urban areas. In this article, we will address the concept of autonomous fraction, existing types, applicable legislation, technical, financial and tax aspects, examples and usefulness.

Index

- What is an Autonomous Fraction?

- Types of Autonomous Fractions

- Legislation Applicable to Autonomous Fractions

- Technical Aspects

- Financial and Tax Aspects of an Autonomous Fraction

- What are the rights and obligations of the owners of autonomous fractions?

- Usefulness and Examples of Autonomous Fractions

- Frequently Asked Questions about Autonomous Fractions

What is an Autonomous Fraction? (Top▲)

An autonomous fraction is a part of a building or group of buildings that can be the exclusive property of a person or entity and be sold autonomously, independently of the other fractions and common areas of the condominium.They are normally apartments, garages, shops or offices inserted in buildings with areas for collective use, such as corridors, stairs and elevators, terraces, condominium rooms or rooms for common use.

The autonomous fractions have an independent entrance and have their own areas and facilities. In the case of open spaces for parking vehicles, in condominium garages, they are generally not constituted as an autonomous fraction, but are attached to a certain fraction.

Types of Autonomous Fractions (Top▲)

Autonomous fractions can be classified according to their use:

- Residential: residential apartments, tourist apartments, the floor of the house (provided that division has been carried out), garages and other types of private dwellings constituted under a horizontal property regime;

- Commercial: stores, offices, offices and other spaces for commercial and professional activities;

- Industrial: warehouses, factories and other spaces intended for industrial activity, provided they are constituted under a horizontal property regime;

- Mixed: fractions that combine different uses, such as housing and commerce, or offices and industry.

Legislation Applicable to Autonomous Fractions (Top▲)

The Portuguese legislation that regulates autonomous fractions and condominiums can be found in the Civil Code, namely in articles 1414.º to 1438.º-A.

These articles establish the horizontal property rules, defining the rights and obligations of the owners, the common parts of the building and the responsibilities related to the administration and maintenance of the condominium.

Technical Aspects (Top▲)

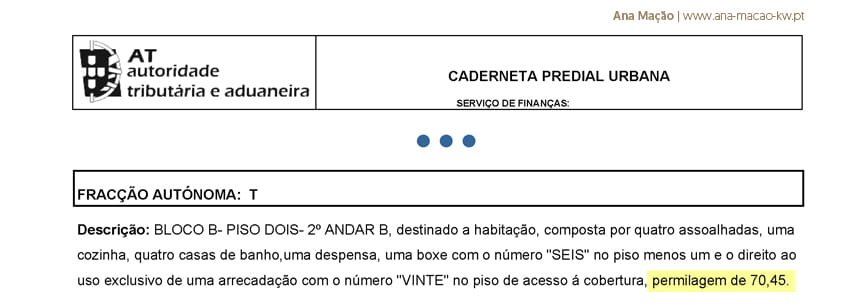

The autonomous fraction is identified by one (or more) capital letters or a number, usually from bottom to top, and starting with the letter "A", (after the letter "Z" follows the letter "AA", etc.) followed by a detailed description of the areas, limits and characteristics of the space.

The delimitation and description of the autonomous fractions are carried out by a competent technician, such as an architect or engineer, in a notarial deed ( Constitutive Title of Horizontal Property ) and registered at the Land Registry Office. In addition to the description and identification of the fractions, the "permilage" of each fraction must be part of the Constitutive Title (see below how this is determined). It is this permil that serves to determine the participation of each fraction in the expenses of the condominium, as well as the number of votes of the owner, for the purposes of the general assembly of the condominium.

It is important that the autonomous fractions comply with the applicable technical and safety standards, such as those relating to construction, electrical and gas installations, thermal and acoustic insulation, among others.

Financial and Tax Aspects of an Autonomous Fraction (Top▲)

The purchase and sale of an autonomous fraction involves several costs, such as the acquisition price, taxes, fees and expenses with deeds and registrations. In addition, owners of autonomous fractions are responsible for paying condominium fees, which include maintenance and conservation expenses for common areas.

With regard to taxes, owners of autonomous fractions must pay the Municipal Property Tax (IMI), which is calculated based on the taxable value of the property and the rate set by the municipality. Other relevant taxes include the Tax on the Onerous Transfer of Real Estate (IMT), applicable to the purchase and sale of autonomous fractions, and the Stamp Tax, which is levied on the deed and other transactions related to real estate.

How is the permileage of an autonomous fraction calculated? (Top▲)

The permil of an autonomous fraction is calculated based on the proportion of the fraction's value in relation to the total value of the building.This value is usually attributed when carrying out the first valuation of the property for registration in the urban property matrix, as a rule, by the builder and takes into account several factors, such as: the useful area of the fraction, the dependent area (garages, balconies and terraces, storage, etc.), the location and the quality of the finishes. That is, it may even happen that a fraction that has a lower useful area than another fraction, has a higher permil. This value will appear in the property booklet:

To calculate the percentage of a fraction, these are the steps:

- The value of the autonomous fraction is calculated, taking into account the criteria mentioned above.

- The total value of the building is calculated, adding the value of all the autonomous fractions and the common areas.

- Divide the value of the autonomous fraction by the total value of the building and multiply the result by 1,000 (since permil is expressed in parts per thousand).

For example, if an autonomous fraction has a value of 150,000 euros and the total value of the building is 1,000,000 euros, the permil of that fraction will be:

(150,000 / 1,000,000) x 1,000 = 150 permil (or 15% of the total)

The fraction permilage is used to determine two values:

- The proportion to be paid in the condominium fee, relative to the maintenance and conservation expenses of the common areas of the condominium (payment of common services such as water, electricity, elevators, cleaning, etc.), as well as the contribution in carrying out works (painting, roof repair, etc.).

- And the number of votes attributed to each owner, at the condominium assembly, although this distribution may be equitable if this is decided at a condominium assembly.

Is it possible to change the permileage of an autonomous fraction?(Top▲)

Yes, it is possible to change the permil of an autonomous fraction, as long as there is an agreement between all the fraction owners and that the change is duly justified, as in the case of expansion or remodeling works that change the area or the value of the fraction. To change the permilage, it is necessary to change the constitutive title of the horizontal property and register the new permilage at the land registry office.

What are the rights and obligations of the owners of autonomous fractions? (Top▲)

The owners of autonomous fractions have rights and obligations (Civil Code, in articles 1414.º to 1438.º-A), in order to guarantee a harmonious coexistence and good management of the condominium. Among the main rights and obligations, the following stand out:

Rights:

- Right of use and fruition: the owners have the right to use and enjoy their autonomous fractions and the common areas of the building;

- Participation in the administration of the condominium: the owners have the right and the obligation to participate in the administration of the condominium, being able to be elected to positions in the administration body, through the assembly of owners;

- Have access and use the common areas of the building, in accordance with its purpose and the rules established in the constitutive title of the horizontal property;

- Require compliance with the obligations of other owners, including payment of condominium fees and maintenance of common areas.

Obligations:

- Contribute to the maintenance and conservation costs of the common areas of the building, by paying the condominium fees established based on the permilage of its autonomous fraction;

- Conservation obligations: the owners are responsible for the maintenance and conservation of their autonomous fractions and must contribute to the maintenance costs of the common areas;

- Comply with the legal norms and the provisions of the deed of horizontal property, as well as the decisions taken at the joint owners' meeting;

- Do not carry out activities that cause inconvenience, disturbance or damage to other owners or residents of the building;

- Allow access to its autonomous fraction, when necessary, to carry out works or inspections in thecommon areas of the building or neighboring fractions, provided that the terms and conditions established by law are respected.

Usefulness and Examples of Autonomous Fractions (Top▲)

Autonomous fractions are a common solution in urban areas, where population density and the need to optimize the use of space justify the construction of buildings with multiple residential or commercial units. These spaces are especially useful for people looking for homes, offices or shops in central locations with easy access to services and infrastructure.

Examples of autonomous fractions include:

- An apartment in a residential building with several units;

- An office located in a business center;

- A store in a shopping center;

- A workshop in an industrial complex.

Frequently Asked Questions about Autonomous Fractions (Top▲)

What are the different types of autonomous fractions?

Autonomous fractions can be classified according to their use:

- Residential: apartments, villas and other types of private housing;

- Commercial: stores, offices, offices and other spaces for commercial and professional activities;

- Industrial: warehouses, factories and other spaces intended for industrial activity;

- Mixed: fractions that combine different uses, such as housing and commerce, or offices and industry.

How is an autonomous fraction identified?

An autonomous fraction is identified by a capital letter or a number, followed by a detailed description of the areas, limits and characteristics of the space. The identification of the autonomous fractions appears in the constitutive title of the horizontal property and must be registered at the land registry office.

Who is responsible for maintaining the common areas in a building with autonomous fractions?

The owners of the autonomous fractions are jointly responsible for the maintenance and conservation of the common areas of the building, such as corridors, stairs, elevators and gardens. Maintenance expenses are divided between the owners, generally based on the permileage of each fraction, as established in the constitutive title of the horizontal property.

What are the main taxes associated with autonomous fractions?

The main taxes associated with autonomous fractions are:

- Municipal Property Tax (IMI): annual tax calculated based on the taxable value of the property and the rate defined by the municipality;

- Tax on the Onerous Transfer of Real Estate (IMT): tax applicable on the purchase and sale of autonomous fractions;

- Stamp Duty: tax levied on deeds and other operations related to real estate.

How is the condominium fee calculated for an autonomous fraction?

The condominium quota of an autonomous fraction is calculated based on the permil allocated to each fraction, as established in the constitutive title of the horizontal property. The permilage, which can be consulted in the Building Booklet, represents the proportion of common areas of the building that correspond to each autonomous fraction.It is used to determine, on a proportional basis, the value of the condominium fee to be paid by the owner of the fraction, for the maintenance and conservation expenses of the common areas.

What is the constitutive title of horizontal property?

The constitutive title of horizontal property is a legal document that establishes and regulates the division of a building or group of buildings into autonomous fractions. This document includes important information, such as the identification and description of the autonomous fractions, the permil assigned to each fraction, the rights and obligations of the owners, and the rules of administration and maintenance of the condominium. The constitutive title must be registered at the land registry office.

How is horizontal property constituted?

The horizontal property is constituted through the elaboration and registration of the constitutive title, which establishes the division of the building into autonomous fractions, each with an independent entrance, as well as the common areas. The constitutive title contains detailed information about the autonomous fractions, the common areas of the building, the permil of each fraction and the rules of administration and maintenance of the condominium (optional). The constitutive title must be drawn up by a competent technician, such as an architect or engineer, and registered at the land registry office.

What is the difference between autonomous fraction and common areas?

The autonomous fraction is a part of a building or group of buildings that can be the exclusive property of a person or entity, regardless of the common areas of the condominium. The autonomous fractions have an independent entrance and have their own areas and facilities. Examples of autonomous fractions include apartments, shops and offices inserted in buildings with areas for collective use.

Common property or common areas refer to the parts of the building or set of buildings that are shared by the owners of the autonomous fractions. These common areas include corridors, stairs, elevators, gardens, roofs and other facilities and spaces that are not part of the autonomous fractions. The owners of the autonomous fractions are jointly responsible for the maintenance and conservation of the common areas of the building, and the expenses are divided between them based on the permileage of each fraction, as established in the constitutive title of the horizontal property.

Is it possible to divide an autonomous fraction into 2 or more fractions?

It is possible as long as you have the authorization of the deed of incorporation or the assembly of owners, approved without any opposition. If so, the owner of the fraction is responsible for, by means of a unilateral act in a public deed, introducing the corresponding change in the constitutive title, and communicating the same to the administrator within a period of 30 days.

Is it possible to combine 2 or more autonomous fractions into one?

The joining of two or more fractions of the same building does not require authorization from the other owners, as long as they are contiguous. The contiguity of fractions is waived in the case of fractions corresponding to storage rooms and garages. It is up to the owner of the fractions, by means of a unilateral act in a public deed, to introduce the corresponding change in the constitutive title, and communicate the same to the administrator within a period of 30 days.

Important Note: The information in this glossary is for informational purposes only. For proper advice on legal or tax matters, consultation with a duly authorized lawyer, notary, solicitor, or accountant is essential.

Your next step in the real estate market

Whether you want to sell your property for the maximum value or find the ideal home, count on my experience as a Top Producer consultant at KW Portugal. Talk to me without obligation. Start today with a simple contact.

Contact Me Today

Related articles