Whenever we witness a period of strong growth in the sale prices of houses and other properties, the press, commentators and other interested parties predict in chorus that "the bubble is about to burst" and that house prices will suffer a sharp drop. This is what we've been hearing over and over for the last 3, 4 years.

This expectation is sufficient for:

- Some buyers wait for the "bubble to burst" waiting for the promised price drop.

- Some more opportunistic investors enter the field with " balance price proposals", pointing the finger at the imminent recession.

- Some owners give up putting the property up for sale , waiting for better days.

- Some real estate consultants and agencies advise their clients to sell their homes urgently "and for the price possible, before the bubble bursts" and they lose money.

Reasons to foresee the imminence of a real estate crisis

- The negative impact of the pandemic since 2020;

- The strong growth in property prices since 2016;

- Inflation that has affected purchasing power and construction costs since 2021-22;

- The war in Ukraine with the consequent shake-up of confidence in the economies, in 2022-2023;

- Restrictions on access to mortgage loans and the increase in interest rates , in 2022/2023;

Anyway... there is no shortage of reasons to predict an "imminent bursting of the bubble" in real estate prices.

But, the "shortly" has been going on for 4 years now and if the bubble has burst, you don't see the damage identical to the ones we saw in the past, for example. between 2008 and 2011. At that time, prices dropped sharply or remained stagnant for years.

But the "prophets of doom" remain convinced and now predict that the "bubble" will burst in 2023.

But are we really talking about a "speculative bubble"? And why doesn't the bubble burst?

To begin with, it is good to remember that the evolution of prices in this sector is cyclical , whether in Portugal or in the rest of the world, and that after each cycle of growth, there follows a cycle of correction or cooling. It's historic and watchable. But what there is no record of is a devaluation cycle that persists in the long term.

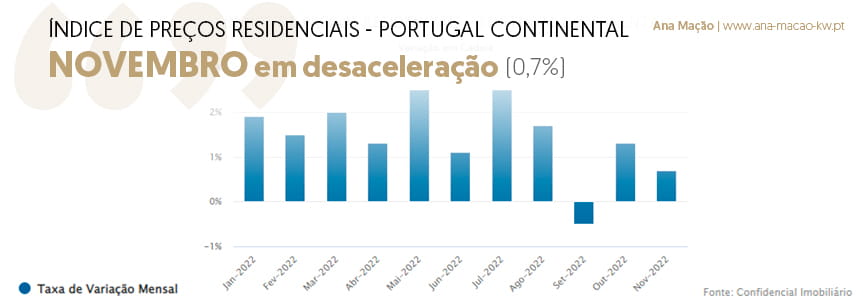

Despite housing prices having grown by 18.7% in 2022 , the highest value in the last 30 years, according to the Residential Price Index of Confidencial Imobiliário , in the second half of 2022 a deceleration has already begun, with the monthly rate of change down to 0.7% in November :

Why doesn't the "bubble" burst?

1 - Currently, real estate investment is a good option for savings and capital appreciation, as an alternative to other investment options, because in the long term a property rarely loses value.

This is one of the reasons why prices are not coming down, despite the setbacks mentioned above. Domestic and foreign investment continues to flow into the real estate sector (especially in the new construction or mid-high market segment).

Faced with the instability of the stock markets and the low rates of return on bank deposits, investors continue to choose to invest in the real estate market. The rate of return is high and the medium to long term risk is low.

2 - On the other hand, a decade of almost freezing prices, both in the market for the resale of second-hand homes and in the construction of new homes, resulted in additional pressure on the part of owners and developers. And they want to recover the margins lost in the past.

3 - Moreover, the growth of tourist activity , which has already surpassed pre-pandemic levels, continues to put upward pressure on the real estate sector . Not even the "end" of the Visa Gold program in large cities and on the coast has attenuated this trend. Portugal continues to be an attractive country, to live or spend holidays and foreigners with greater purchasing power continue to flock and boost this sector.

4 - Macroeconomic variables have not deteriorated as much as was assumed 3 years ago: unemployment remains at historically low levels and there is more liquidity than in the housing crisis of 2008, thanks in part to economic aid policies coming from Brussels and the ECB.

The Bubble is only for some, that is, for the Portuguese

Thus, when we speak of a "bubble" we are talking about a mismatch between the purchasing power of national buyers and house prices practiced in Portugal , because their incomes have not accompanied this spiral of growth. And these are the ones who feel the most harmed and who have the most hope in a hypothetical "crash" in house prices.

In counter-cycle, foreign buyers never gave up on our market , even when prices reached levels identical to other richer European cities. The reason is simple, their purchasing power is much higher than that of the Portuguese.

In any case, it is important to remember that the appreciation of the last 7 years has fundamentally affected the large urban areas, with Lisbon at the head. But it is good to remember that the city of Lisbon was never accessible. If we go back in time and over the decades, the capital has always been one of the most expensive places to buy a house.

In summary, this is a serious problem, as what has been observed here and a little throughout Europe is the resilience of prices, which continue their appreciation journey, despite the wage freeze and reduction in purchasing power, having suffered some cooling only in some countries, such as Sweden.

It is urgent to change the State housing policies

Paradoxically, as the housing problem has been getting worse, both in the sale and rental markets, tax revenues have not stopped increasing! The same State that regulates and legislates to combat spiraling prices, thus demonstrating its concern for the sector, collects more and more tax revenues through the many taxes and fees that burden the sector:

Paradoxically, as the housing problem has been getting worse, both in the sale and rental markets, tax revenues have not stopped increasing! The same State that regulates and legislates to combat spiraling prices, thus demonstrating its concern for the sector, collects more and more tax revenues through the many taxes and fees that burden the sector:

- Taxes on income received (varies between 25% and 28%);

- Taxes on Capital Gains .Applies whenever a property is sold for a price higher than the purchase price (25%, despite some exemptions);

- IMI - Municipal Property Tax, which is charged annually (varies between 0.3% and 0.5% of the property's equity value).

- IMT - Municipal Tax on Real Estate Transfers charged on the acquisition of a property (varies between 5% and 10%).

- AIMI - Additional to IMI, charged annually and whose rate varies between 0.4% and 7.5% on a part of the property portfolio, whenever it exceeds €600,000 and according to a staggered formula.

- Stamp Duty - It is levied on various operations, from the acquisition of real estate to mortgages and whose rate varies between 0.8% and 7.5%.

To this set of taxation must be added all the fees and taxes levied on the construction and mediation sector.

In short, when looking at the formation of sales or rental prices for houses, there is a tendency to point the finger only at developers, landlords and foreign buyers, when the State is one of the entities with more weight in price formation .

Despite the promises that have been made over the decades by various governments and municipalities, the solution does not seem to lie in active housing policies, which are their direct responsibility. There are many bodies set up with the purpose of building and managing the State's housing assets, but the results have always fallen short and have not responded to the growing demand for affordable housing.

Freezing prices, or punishing "speculators" with more taxes, has not been able to solve the problem, because in the end, it is fiscal policies and the balance between demand and supply that end up having the most influence in this market.

As long as there is hope there is no solution - Friedrich Nietzsche

This is the real problem. For decades, the Portuguese have hoped that the housing problem will be resolved by decree law, or who knows, over time. Perhaps, thanks to a bubble that will burst...

Time has passed, hope has not died, but the problems have been getting worse. So, we have to abandon hope and move on to action. And the action could go through two strategies whose impact is unquestionable:

- De-bureaucratize the licensing that stops and delays the construction of new housing, even when the defense of the Municipal Master Plans, or other environmental causes, is not at stake. Facilitating an increase in supply is the right way to satisfy demand. When demand is not satisfied, prices reflect this imbalance.

- Reduce the tax burden on the sector, which is one of the main reasons why sales and lease prices are so high.

If housing is one of the main concerns of politicians and the Portuguese, why not exchange hope for action? It is not just about meeting one of the main needs of families, but also improving the economic environment of many professionals who depend on this activity.

The construction and mediation sector was and will always be one of the country's main economic drivers, penalizing it more than the rest will not solve the housing problem , but rather exacerbate it, as has been seen.

When we stop worrying about the "real estate bubble" and reduce the multiple entropies that affect this sector, we will be able to exchange hope for reality.